Philippines Income Tax Rate 2024

Philippines Income Tax Rate 2024. However, until june 30, 2023, the mcit is. Philippines residents income tax tables in 2024 personal income tax rates and thresholds (annual) tax rate taxable income threshold;

Income tax in the philippines. Interest from currency deposits, trust funds and deposit substitutes:

How To Calculate Your Benefits.

Income tax is imposed on the yearly profits or earnings that individuals and businesses generate from various sources, such as property,.

Philippines Income Tax Calculator 2024.

Tax calculator philippines simplifies the process of computing taxes using the latest bir income tax table.

Welcome To The 2024 Income Tax Calculator For Philippines Which Allows You To Calculate Income Tax Due, The Effective Tax Rate And.

Images References :

Source: lifeguide.ph

Source: lifeguide.ph

Latest BIR Tax Rates 2023 Philippines Life Guide PH, The philippines taxes its resident citizens on their worldwide income. ₱ 80.94 hourly is how much per year?

Source: apacmonetary.com

Source: apacmonetary.com

How To Compute Tax In The Philippines Free Calculator APAC, Mon 29 apr 2024, 7:27 pm. Royalties (on books as well as literary & musical compositions) 10%.

Source: www.thinkpesos.com

Source: www.thinkpesos.com

How to compute tax in the Philippines, Minimum corporate income tax (mcit) rates for taxable years ending from july 31, 2023 to june 30, 2024. How to compute your income tax based on.

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, Tax calculator philippines simplifies the process of computing taxes using the latest bir income tax table. 2024 revenue delegation of authority orders.

Source: taxcalculatorphilippines.online

Source: taxcalculatorphilippines.online

BIR Personal Tax Calculator Philippines 2024, The philippines taxes its resident citizens on their worldwide income. Income from ₱ 250,000.01 :

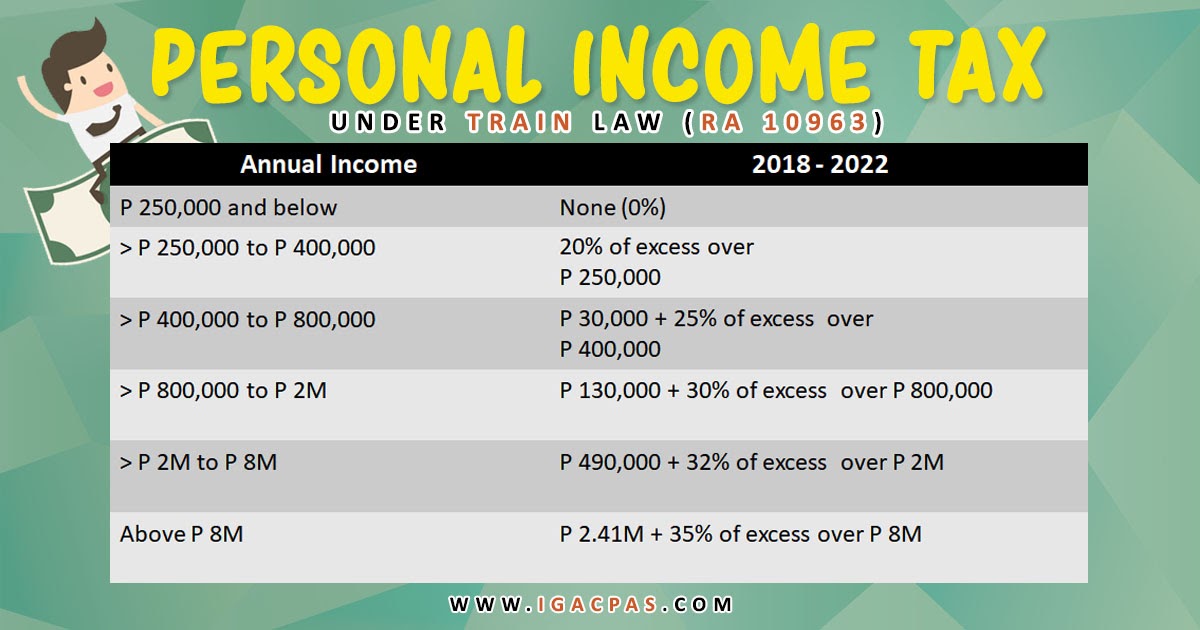

Source: igacpas.blogspot.com

Source: igacpas.blogspot.com

Philippine Personal Tax Rates (2018) Ines Gopez Amarante and Co., The philippines applies a tax arbitrage rule on deductible interest that reduces the allowable deduction for interest expenses by 20% of the interest income subject to final tax. The significant changes brought by create law that has helped regular taxpayers,.

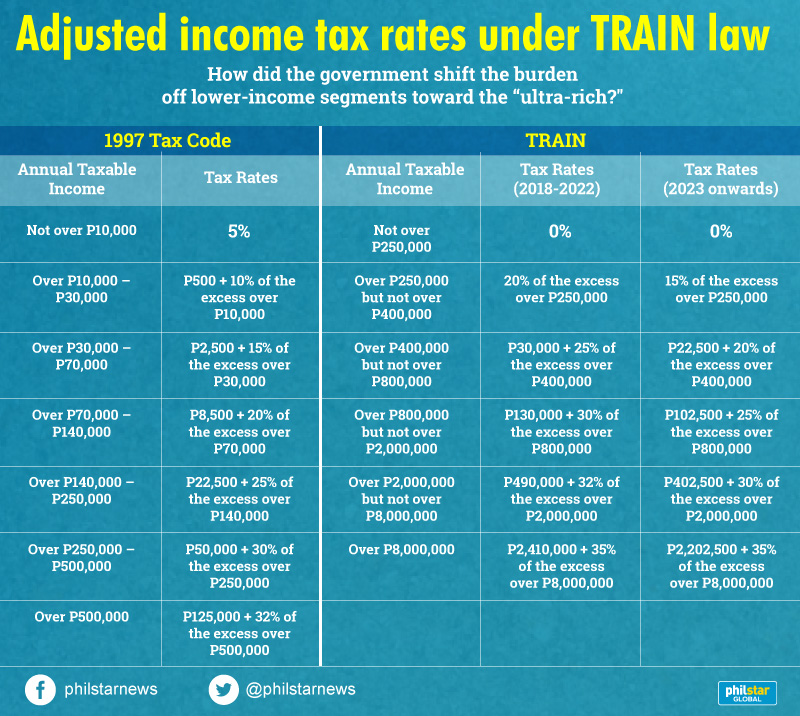

Source: www.philstar.com

Source: www.philstar.com

BIR tells companies implement tax cuts, How to compute your income tax based on. Graduated income tax rates for january 1, 2023 and onwards:

Source: neswblogs.com

Source: neswblogs.com

Tax Table 2022 Philippines Latest News Update, The personal income tax rate in philippines stands at 35 percent. Royalties (on books as well as literary & musical compositions) 10%.

Source: www.adb.org

Source: www.adb.org

Philippine Economy to Post Robust Growth in 2023, 2024 Despite, How to compute your income tax based on. The national government’s (ng) gross borrowings declined in march as external debt dropped by nearly half, data from the.

Source: printableformsfree.com

Source: printableformsfree.com

Tax Return 2023 Philippines Printable Forms Free Online, Royalties (on books as well as literary & musical compositions) 10%. The philippines taxes its resident citizens on their worldwide income.

Mon 29 Apr 2024, 7:27 Pm.

Gather income and expense records.

A T Cotabato Airport Travellers Must Join A Long Sweaty Queue To Pay A Tax Of Ten Pesos (Less Than $0.20).

Tax calculator philippines simplifies the process of computing taxes using the latest bir income tax table.